You are given the price of a nondividend paying stock St and a European call option Ct

Question:

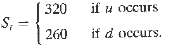

You are given the price of a nondividend paying stock St and a European call option Ct in a world where there are only two possible states

The true probabilities of the two states are given by {Pu = .5, Pd = .5}. The current price is St = 280. The annual interest rate is constant at r = 5%. The time is discrete, with ? = 3 months. The option has a strike price of K = 280 and expires at time t + ?.

(a) Find the risk-neutral martingale measure P* using the normalization by risk-free borrowing and lending.

(b) Calculate the value of the option under the risk-neutral martingale measure using

Ct = 1 / 1 +r? EP*[Ct+?]

(c) Now use the normalization by St and find a new measure P under which the normalized variable is a martingale

(d) What is the martingale equality that corresponds to normalization by St?

(e) Calculate the option?s fair market value using the P.

(f) Can we state that the option?s fair market value is independent of the choice of martingale measure?

(g) How can it be that we obtain the same arbitrage-free price although we are using two different probability measures?

(h) Finally, what is the risk premium incorporated in the option?s price? Can we calculate this value in the real world? Why not?

Strike PriceIn finance, the strike price of an option is the fixed price at which the owner of the option can buy, or sell, the underlying security or commodity.

Step by Step Answer:

An Introduction to the Mathematics of financial Derivatives

ISBN: 978-0123846822

2nd Edition

Authors: Salih N. Neftci