A company wants to raise $50 million to finance the following capital expenditure projects, with their respective

Question:

A company wants to raise $50 million to finance the following capital expenditure projects, with their respective rates of return.

Project A ……………………. 8%

Project B ……………………. 9%

Project C ……………………. 10%

Project D ……………………. 11%

Project E ……………………. 12%

Project F ……………………. 13%

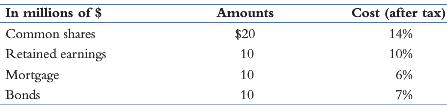

The various sources and cost of funds are as follows:

1. What is the company’s cost of capital?

2. What discount rate would you use during the capital budgeting process?

3. What would be the new discount rate if the cost of common shares and mortgage increase to 16% and 7%, respectively?

4. What projects would be approved with and without the change in the cost of capital?

Capital BudgetingCapital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: