Ace Mining Company (the parent) acquired 100% of the common stock of Alberta Development (the subsidiary) for

Question:

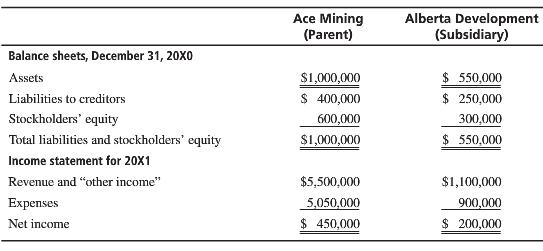

Ace Mining Company (the parent) acquired 100% of the common stock of Alberta Development (the subsidiary) for $300,000 on January 2, 20X1. Their financial statements follow:

1. What would be Ace Mining’s net income for 20X1 if it had not purchased the Alberta Development stock?

2. After acquiring the Alberta Development stock, Ace Mining prepared its income statement by showing its claim to Alberta’s income as part of “other income.” Prepare a consolidated income statement for 20X1 and a consolidated balance sheet as of December 31, 20X1. Use the balance- sheet-equation format for the latter.

3. Suppose Ace Mining Company bought only 60% of Alberta Development Company for $180,000.

Therefore, Ace Mining’s revenue and other income for 20X1 is $5,420,000, not $5,500,000.

Prepare a consolidated income statement and a consolidated balance sheet. Use the balance-sheet-equation format for the latter.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Consolidated Income Statement

When talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is...

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta