Question:

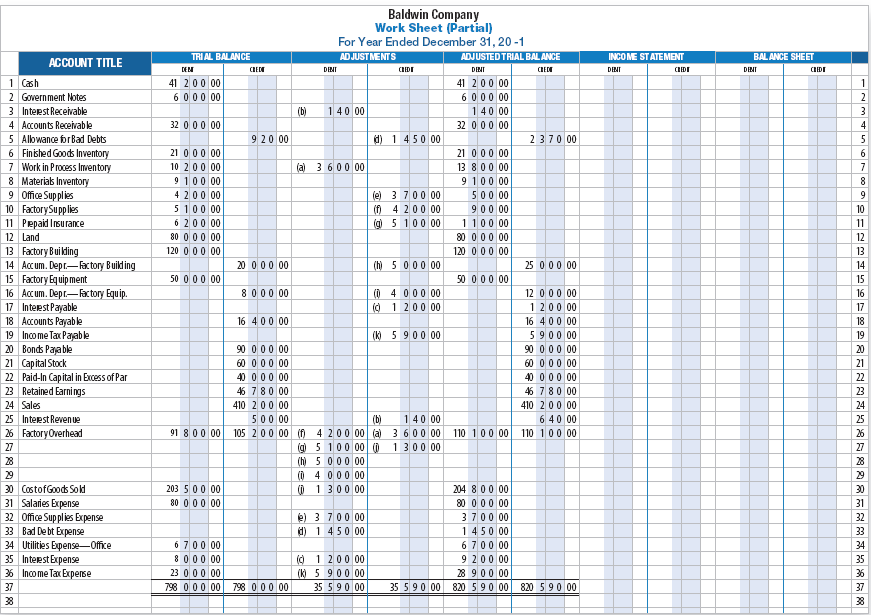

ADJUSTING, CLOSING, AND REVERSING ENTRIES A partial work sheet for Baldwin Company is shown on the next page.

Data for adjusting the accounts are as follows:

(a) Factory overhead to be applied to work in process ending inventory ...$3,600

(b) Interest receivable ........................140

(c) Interest payable .........................1,200

(d) Estimate of uncollectible accounts, based on an aging

of accounts receivable ......................2,370

(e) Office supplies consumed ....................3,700

(f) Factory supplies consumed ..................4,200

(g) Insurance on factory building and equipment expired .........5,100

(h) Factory building depreciation .................5,000

(i) Factory equipment depreciation .................4,000

(j) Underapplied factory overhead ..................1,300

(k) Provision for corporate income taxes ..............5,900

REQUIRED

1. Prepare the December 31 adjusting journal entries for Baldwin Company.

2. Prepare the December 31 closing journal entries for Baldwin Company.

3. Prepare the reversing journal entries as of January 1, 20-2, for BaldwinCompany.

Ending Inventory

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Transcribed Image Text:

Baldwin Company Work Sheet (Partial) For Year Ended December 31, 20 -1 AD JUSTMENTS ADJUSTED TRIAL BAL ANCE TRI AL BALANCE INCOME ST ATEMENT BAL ANCE SHEET ACCOUNT TITLE DEN CEDE DINI CIDI DINI CEDE DENI CEDI DINI CEDI 41 200 00 6000 00 1 Cash 2 Government Notes 3 Inteest Receivable 41 200 00 6000 00 (b) 140 00 140 00 32 000 00 32 000 00 4 Accounts Receivable 4 d) 1 450 00 5 Alowance forBad Debts 920 00 2370 00 6 Finshed Goods Inventory 7 Work in Process Inventory 8 Material Inventory 9 Office Sup pl ies 10 FactorySupplies 11 Pepaid Insurance 21 000 00 21 000 00 10 200 00 (a) 3 600 00 13 800 00 9100 00 500 00 900 00 1100 00 9 100 00 4 200 00 (e) 3 700 00 (f) 4 200 00 (g) 5 100 00 5100 00 6 200 00 80 000 00 120 0 00 00 10 11 12 Land 80 000 00 12 120 0 00 00 13 Factory Buikling 14 Accum. Depr.- Factory Buikd ing 15 Factory Equip ment 16 Accum. Depr.-Fac tory Equip. 17 Interst Payable 18 Accounts Payable 19 Inco me Tax Payable 20 Bonds Payable 21 Capital Stock 22 Paid-In Capital in Excess of Par 23 Retained Earni ngs 24 Sales 13 20 000 00 (h) 5 000 00 25 0 00 00 14 50 000 00 50 0 00 00 15 (0 4 000 00 (O 1 200 00 8000 00 12 000 00 16 1200 00 17 16 4 00 00 16 400 00 18 (k) 5 900 00 5900 00 19 90 000 00 90 000 00 20 60 000 00 60 000 00 21 40 000 00 40 000 00 22 46 7 80 00 46 780 00 23 410 200 00 410 200 00 24 25 Interst Revenue 500 00 (b) 140 00 6 40 00 25 26 FactoryOverhead 91 8 00 00 105 200 00 (f) 4 200 00 (a) 3 600 00 (g) 5 100 00 0 110 100 00 110 100 00 26 1300 00 27 27 28 (h) 5 000 00 28 (0 4 000 00 (0 1300 00 29 29 204 8 00 00 80 000 00 203 500 00 80 000 00 30 CostofGoods Sold 30 31 Salaries Expense 32 Office Supplies Expense 33 Bad De bt Expense 34 Utilities Expense-Office 35 Inteest Expense 36 Inco me Tax Expense 31 e) 3 700 00 d) 1 450 00 3700 00 32 1450 00 6700 00 9 200 00 28 900 00 35 590 00 820 590 00 820 590 00 33 6 700 00 34 (0 1 200 00 (k) 5 900 00 8 000 00 35 23 0 00 00 798 000 00 798 0 00 00 37 35 5 90 00 37 38 38