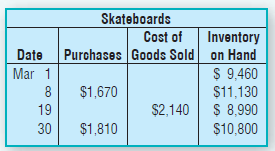

Assume Bob's Boards has the following LIFO perpetual inventory record for skateboards for the month of March:

Question:

Assume Bob's Boards has the following LIFO perpetual inventory record for skateboards for the month of March:

At March 31, the accountant for Bob’s Boards determines that the current replacement cost of the ending inventory is $10,640. Make any adjusting entry needed to apply the lower-of-cost-or-market rule. Inventory would be reported on the balance sheet at what value on March 31?

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: