Java Source, Inc. (JSI), is a processor and distributor of a variety of blends of coffee. The

Question:

Java Source, Inc. (JSI), is a processor and distributor of a variety of blends of coffee. The company buys coffee beans from around the world and roasts, blends, and packages them for resale. JSI offers a large variety of different coffees that it sells to gourmet shops in one-pound bags. The major cost of the coffee is raw materials. However, the company’s predominantly automated roasting, blending, and packing processes require a substantial amount of manufacturing overhead. The company uses relatively little direct labor.

Some of JSI’s coffees are very popular and sell in large volumes, while a few of the newer blends sell in very low volumes. JSI prices its coffees at manufacturing cost plus a markup of 25%; with some adjustments made to keep the company’s prices competitive.

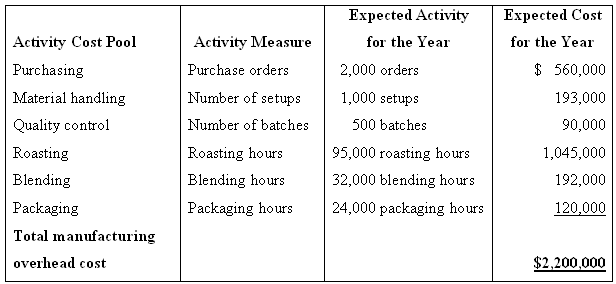

For the coming year, JSI’s budget includes estimated manufacturing overhead cost of $2,200,000. JSI assigns manufacturing overhead to products on the basis of direct labor-hours. The expected direct labor cost totals $600,000, which represents 50,000 hours of direct labor time. Based on the sales budget and expected raw materials costs, the company will purchase and use $5,000,000 of raw materials (mostly coffee beans) during the year.

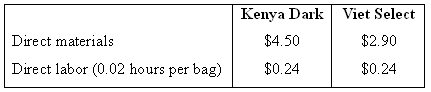

The expected costs for direct materials and direct labor for one-pound bags of two of the company’s coffee products appear below.

JSI’s controller believes that the company’s traditional costing system may be providing misleading cost information. To determine whether or not this is correct, the controller has prepared an analysis of the year’s expected manufacturing overhead costs, as shown in the following table:

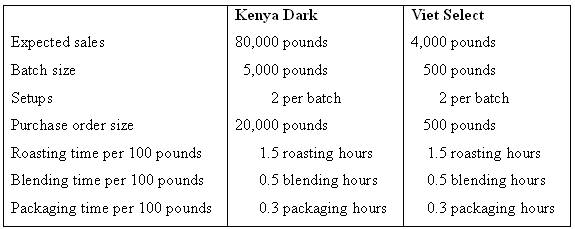

Data regarding the expected production of Kenya Dark and Viet Select coffee are presented below.

Required:

Using direct labor-hours as the base for assigning manufacturing overhead cost to products, do the following:

a. Determine the predetermined overhead rate that will be used during the year.

b. Determine the unit product cost of one pound of the Kenya Dark coffee and one pound of the Viet Select coffee.

2. Using activity-based costing as the basis for assigning manufacturing overhead cost to products, do the following:

a. Determine the total amount of manufacturing overhead cost assigned to the Kenya Dark coffee and to the Viet Select coffee for the year.

b. Using the data developed in (2a) above, compute the amount of manufacturing overhead cost per pound of the Kenya Dark coffee and the Viet Select coffee. Round all computations to the nearest whole cent.

c. Determine the unit product cost of one pound of the Kenya Dark coffee and one pound of the Viet Select coffee.

3. Write a brief memo to the president of JSI explaining what you have found in (1) and (2) above and discussing the implications to the company of using direct labor as the base for assigning manufacturing overhead cost to products.

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer