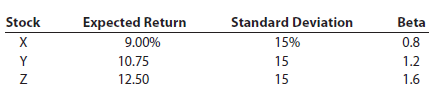

Consider the following information for three stocks, Stocks X, Y, and Z. The returns on the three

Question:

Consider the following information for three stocks, Stocks X, Y, and Z. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.)

Fund Q has one-third of its funds invested in each of the three stocks. The risk-free rate is 5.5%, and the market is in equilibrium. (That is, required returns equal expected returns.)

a. What is the market risk premium (rM – rRF)?

b. What is the beta of Fund Q?

c. What is the expected return of Fund Q?

d. Would you expect the standard deviation of Fund Q to be less than 15%, equal to 15%, or greater than 15%? Explain.

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Step by Step Answer:

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston