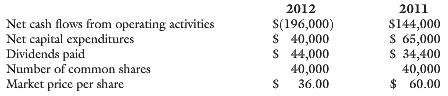

Data for Whale Corporation in 2012 and 2011 follow. These data should be used in conjunction with

Question:

Data for Whale Corporation in 2012 and 2011 follow. These data should be used in conjunction with the data in P 2.

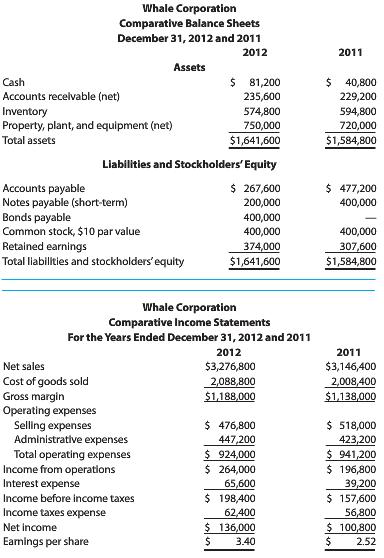

In P 2. Whale Corporation’s condensed comparative balance sheets and condensed comparative income statements for 2012 and 2011 follow.

Selected balances at the end of 2010 were accounts receivable (net), $206,800; inventory, $547,200; total assets, $1,465,600; accounts payable, $384,600; and stockholders’ equity, $641,200. All of Whale’s notes payable were current liabilities; all of its bonds payable were long-term liabilities.

REQUIRED

Perform a comprehensive ratio analysis for 2012 and 2011 following the steps outlined below. (Round all answers to one decimal place.)

1. Prepare a profitability and total asset management analysis by calculating for each year the

(a) Profit margin,

(b) Asset turnover,

(c) Return on assets.

2. Prepare a liquidity analysis by calculating for each year the

(a) Cash flow yield,

(b) Cash flows to sales,

(c) Cash flows to assets,

(d) Free cash flow.

3. Prepare a financial risk analysis by calculating for each year the

(a) Debt to equity ratio,

(b) Return on equity,

(c) Interest coverage ratio.

4. Prepare an operating asset management analysis by calculating for each year the

(a) Inventory turnover,

(b) Days’ inventory on hand,

(c) Receivable turnover,

(d) Days’ sales uncollected,

(e) Payables turnover,

(f) Days’ payable,

(g) Current ratio,

(h) Quick ratio.

5. Prepare a market strength analysis by calculating for each year the

(a) Price/earnings (P/E) ratio

(b) Dividends yield.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer: