Each of the three alternatives shown has a 5-year useful life. If the MARR is 10%, which

Question:

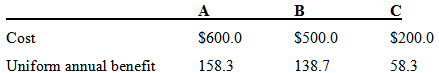

Each of the three alternatives shown has a 5-year useful life. If the MARR is 10%, which alternative should be selected? Solve the problem by benefit-cost ratio analysis.

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Transcribed Image Text:

A $600.0 B $500.0 $200.0 Cost Uniform annual benefit 138.7 58.3 158.3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 76% (13 reviews)

A B C Cost 600 500 200 Uniform Annual Benefit 1583 1387 583 BC OF A 1583600 AP 10 5 100 BC O...View the full answer

Answered By

Mishark muli

Having any assignments and any other research related work? worry less for I am ready to help you with any task. I am quality oriented and dedicated always to produce good and presentable work for the client once he/she entrusts me with their work. i guarantee also non plagiarized work and well researched work to give you straight As in all your units.Feel free to consult me for any help and you will never regret

4.70+

11+ Reviews

37+ Question Solved

Related Book For

Question Posted:

Students also viewed these Economics questions

-

Each of the three columns refers to an independent case. All data represent amounts as of January 1, the date the long- term notes receivable were issued, except for the interest income, which is for...

-

Each of the three learning theories, Cognitivism, Constructivism, and Behaviorism, has worth and merit. Yet, each one has its own unique qualities with one common factor, the learning process. The...

-

Each of the three independent situations below describes a capital lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit rate of...

-

Consider a lottery L1 = [0.5, A; 0.5, L2], where U(A) = 4, and L2 = [0.5, X; 0.5, Y] is a lottery, and U(X) = 4, U(Y) = 8. What is the utility of the the first lottery, U(L1)?

-

Use a graphing utility to graph the function and visually determine the open intervals on which the function is increasing, decreasing, or constant. 1. f (x) = |x| + |x + 1| 2. f (x) = (x2 4)2

-

1. To what events must the SBRU booking system respond? Create a complete event table listing the event, trigger, source, use case, response, and destination for each event. Be sure to consider only...

-

Show that the two representations of the Stefan-Maxwell model given by Eqs. (21.4) and (21.5) are equivalent. ns -VA = j=1 y;Ni-yiNj CDij (21.4)

-

The United States Office of Management and Budget (OMB) provides guidance on the allow ability of costs under federal grant agreements in Uniform Administrative Requirements, Cost Principles, and...

-

Travel agency owners have key salespeople contacts for their suppliers, such as cruise line and tour operator Business Development Managers. Therefore as a professional buyer of travel products, the...

-

Facing dramatically declining sales and decreased turnover, retailers such as Saks Fifth Avenue and JCPenney are rethinking their pricing strategies, scaling back inventories, and improving the...

-

A project will cost $50,000. The benefits at the end of the first year are estimated to be $10,000, increasing at a 10% uniform rate in subsequent years. Using an 8-year analysis period and a 10%...

-

Consider three alternatives, each with a 10-year useful life. If the MARR is 10%, which alternative should be selected? Solve the problem by benefit-cost ratio analysis. A B $150 Cost $800 $300...

-

In preparing a report on internal control, the auditor is required to assess the process used by management in developing their report on internal control. Assume that the auditor did not find any...

-

For a residential building project, the developer has estimated the capital investment, net rental revenue, and resale value after 6 years for the following three scenarios. Given the developer's...

-

What are the mathematical requirements that a wave function must satisfy to represent a physical system? Which the following functions represent physically acceptable wave functions: and f(x) =...

-

A listing of the MFH's ledger accounts as of March 31 is given below: Assets Cash Accounts receivable ($130,000 February sales; $1,600,000 March sales) Stock Prepaid insurance Property and equipment...

-

A mass M is suspended by the system of ideal strings and pulleys shown. The system is static. The string tension is labelled at several positions, but there are only two pieces of string. The long...

-

A stretched string of mass M is fixed at one end on a wall with its other end free to move vertically along a frictionless rod which is at a distance d from the wall. The tension in the string is T...

-

During a flood-relief operation, two boxes having same inertia, one filled with polythene tent material and the other one filled with rice packets, are dropped from a helicopter. Which one will reach...

-

Where are the olfactory sensory neurons, and why is that site poorly suited for their job?

-

Given that many of the most influential ideas about management and leadership derive from the United States, how should Australian business leaders view such North American ideas?

-

Jennifer Lee, an engineering major in her junior year, has received in the mail two guaranteed lineofcredit applications from two different banks. Each bank offers a different annual fee and finance...

-

You received a credit card application from Sun Bank offering an introductory rate of 2.9% per year compounded monthly for the first six months, increasing thereafter to 17% compounded monthly. This...

-

You have just received credit card applications from two banks, A and B. The interest terms on your unpaid balance are stated as follows: 1. Bank A: 18% compounded quarterly. 2. Bank B: 17.5%...

-

Discuss the ethical consderariion relayed to the use of information rechnology for organizational control how can organization ensure responsibility and transparent?

-

The board chair has asked management to develop some strategies to improve profitability and estimate the impact of the strategies on the hospital's return on equity (ROE). By how much would the 2021...

-

Rivan Co. is considering a new three-year expansion project that requires an initial fixed asset investment of $2.18 million in a large building. The fixed asset applies three year MACRS for tax...

Study smarter with the SolutionInn App