Estrada Inc. purchased a building and the land on which the building is situated for a total

Question:

Estrada Inc. purchased a building and the land on which the building is situated for a total cost of $600,000 cash. The land was appraised at $210,000 and the building at $490,000.

Required

a. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building.

b. Would the company recognize a gain on the purchase? Why or why not?

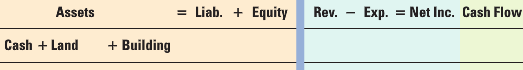

c. Record the purchase in a statements model like the following one.

d. Record the purchase in general journal format.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamental financial accounting concepts

ISBN: 978-0078025365

8th edition

Authors: Thomas P. Edmonds, Frances M. Mcnair, Philip R. Olds, Edward

Question Posted: