Galenic, Inc., is a wholesaler for a range of pharmaceutical products. Before deducting any losses from bad

Question:

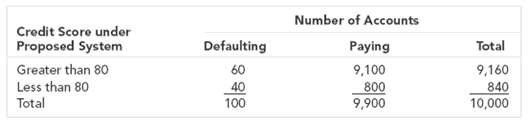

Galenic, Inc., is a wholesaler for a range of pharmaceutical products. Before deducting any losses from bad debts, Galenic operates on a profit margin of 5 percent. For a long time the firm has employed a numerical credit scoring system based on a small number of key ratios. This has resulted in a bad debt ratio of 1 percent. Galenic has recently commissioned a detailed statistical study of the payment record of its customers over the past eight years and, after considerable experimentation, has identified five variables that could form the basis of a new credit scoring system. On the evidence of the past eight years, Galenic calculates that for every 10,000 accounts it would have experienced the following default rates:

By refusing credit to firms with a low credit score (less than 80), Galenic calculates that it would reduce its bad debt ratio to 60/9,160, or just under .7 percent. While this may not seem like a big deal, Galenic?s credit manager reasons that this is equivalent to a decrease of one-third in the bad debt ratio and would result in a significant improvement in the profit margin.

a.?What is Galenic?s current profit margin, allowing for bad debts?

b.?Assuming that the firm?s estimates of default rates are right, how would the new credit scoring system affect profits?

c.?Why might you suspect that Galenic?s estimates of default rates will not be realized in practice? What are the likely consequences of overestimating the accuracy of such a credit scoring scheme?

d. Suppose that one of the variables in the proposed scoring system is whether the customer has an existing account with Galenic (new customers are more likely to default). How would this affect your assessment of the proposal?

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers