In early 2013, Bill MacMillan, one of the shareholders of National Photocell Inc., was completing a proposal

Question:

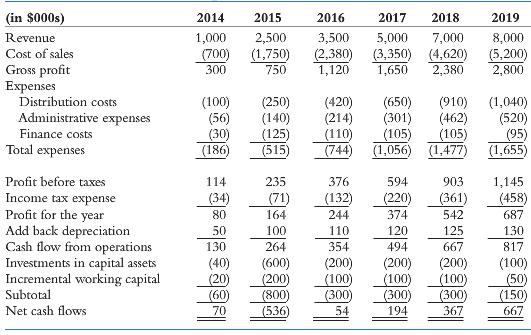

In early 2013, Bill MacMillan, one of the shareholders of National Photocell Inc., was completing a proposal for the expansion of his research-oriented business into a commercial supplier of photochemical equipment. MacMillan felt his proposal was sound. However, he was concerned that the business might have difficulty raising funds, as the project would require a high level of financial support, particularly from high-risk capital investors. Only a few firms, all with their own specialized production, were in the photo-chemical equipment industry. There was little direct product competition, and many opportunities existed for new product innovations. Companies in the industry were typically small, with sales generally less than $3 million per year. MacMillan’s revenue forecast is shown on the statements of income (see Illustration 1). Revenue jumps from $1.0 million in 2014 to $8.0 million by 2019. The forecast period also shows that the net cash flows will have substantial increases from $70,000 in 2014 to $667,000 in 2019. However, National Photocell expects to show a negative net cash flow in 2015 of $536,000.

MacMillan felt that the company would require $1.5 million in financing to set up production, marketing, and training of personnel and for equipment purchases. Investment in capital assets for production start-up would take place in 2014 and continue in 2015. Other funds would be used for working capital, with the heaviest investment in inventories and trade receivables, which would also be required in 2014.

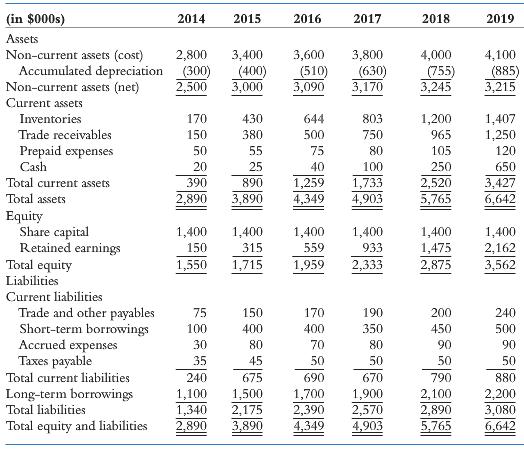

MacMillan felt that traditional lenders would be willing to finance about $500,000 of the new financial needs. This would help with the purchase of the capital assets and some working capital. The remaining $1.0 million would be raised from equity. About 60% of the new equity capital would be provided by existing shareholders and 40% by private investors. The statements of financial position (Illustration 2) show that the inflow of funds from the sale of the common shares would take place in 2014. National Photocell Inc. would operate on a three-year cycle: high growth during the first two years, consolidation and planning for future growth during the third year. Marketing efforts will focus on North America for the first two years and then shift to Europe. MacMillan was of the opinion that these financial needs and financing requirements were very accurate and realistic. Nevertheless, he felt that he would have to prepare a very effective and comprehensive investment proposal to attract one or two investors. He fully understood that risk capital investors are interested in ventures that offer the following:

• A good business opportunity, one that generates a high return

• An excellent management team

• A feasible exit strategy

• The ability to monitor and control their investment

MacMillan was prepared to explain to potential investors how National Photocell could meet their needs. The most important factor would be the potential return the investors expect to earn when they exit the business. MacMillan knew that the investors would want to exit their investment by 2019. He also knew that the business had to demonstrate a superior return. The investors must earn a return between 30% and 40%.

LLUSTRATION 1

National Photocell Inc.

Projected Statements of Income

For the period ended December 31

LLUSTRATION 2

National Photocell Inc.

Protected Statements of Financial Position

As at December 31

1. What will the company’s book value be by 2019?

2. What is the company’s net present value from 2015 to 2019?

3. What is the company’s capitalized value?

4. What is the company’s fair market value?

5. What is the company’s internal rate of return during the five-year period (2015–2019)?

6. What is the company’s internal rate of return using the estimated fair market value?

7. What is the risk capital investor’s internal rate of return on the investment on a before-tax basis? On an after-tax basis?

8. Give your overall impression about the company’s financial projections by using the liquidity ratios, the debt/coverage ratios, the asset management ratios, and the profitability ratios.

9. Do you think that the risk capital investors will be interested in this venture? Why or why not?

(a) High return

(b) Good management team

(c) Exit strategy

(d) Monitor and control

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment...

Step by Step Answer: