In Problem 9-31, Castle Lager has just purchased the Jacksonville Brewery. The brewery is two years old

Question:

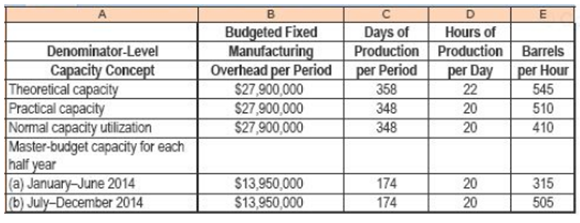

In Problem 9-31, Castle Lager has just purchased the Jacksonville Brewery. The brewery is two years old and uses absorption costing. It will ?sell? its product to Castle Lager at $ 47 per barrel. Peter Bryant, Castle Lager?s controller, obtains the following information about Jacksonville Brewery?s capacity and budgeted fixed manufacturing costs for 2014:

1. If the plant manager of the Jacksonville Brewery gets a bonus based on operating income, which denominator-level capacity concept would he prefer to use? Explain.

2. What denominator-level capacity concept would Castle Lager prefer to use for U. S. income-tax reporting? Explain.

3. How might the IRS limit the flexibility of an absorption-costing company like Castle Lager attempting to minimize its taxable income?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0133428704

15th edition

Authors: Charles T. Horngren, Srikant M. Datar, Madhav V. Rajan