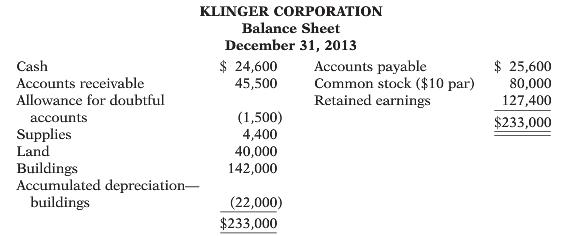

Klinger Corporations balance sheet at December 31, 2013, is presented below. During 2014, the following transactions occurred.

Question:

Klinger Corporation’s balance sheet at December 31, 2013, is presented below.

During 2014, the following transactions occurred.

1. On January 1, 2014, Klinger issued 1,200 shares of $40 par, 7% preferred stock for $49,200.

2. On January 1, 2014, Klinger also issued 900 shares of the $10 par value common stock for $21,000.

3. Klinger performed services for $320,000 on account.

4. On April 1, 2014, Klinger collected fees of $36,000 in advance for services to be performed from April 1, 2014, to March 31, 2015.

5. Klinger collected $276,000 from customers on account.

6. Klinger bought $35,100 of supplies on account.

7. Klinger paid $32,200 on accounts payable.

8. Klinger reacquired 400 shares of its common stock on June 1, 2014, for $28 per share.

9. Paid other operating expenses of $188,200.

10. On December 31, 2014, Klinger declared the annual preferred stock dividend and a $1.20 per share dividend on the outstanding common stock, all payable on January 15, 2015.

11. An account receivable of $1,700 which originated in 2013 is written off as uncollectible.

Adjustment data:

1. A count of supplies indicates that $5,900 of supplies remain unused at year-end.

2. Recorded revenue from item 4 above.

3. The allowance for doubtful accounts should have a balance of $3,500 at year end.

4. Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage value of $10,000.

5. The income tax rate is 30%.

Instructions

(a) Prepare journal entries for the transactions listed above and adjusting entries.

(b) Prepare an adjusted trial balance at December 31, 2014.

(c) Prepare an income statement and a retained earnings statement for the year ending December 31, 2014, and a classified balance sheet as of December 31, 2014.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Accounting Tools for Business Decision Making

ISBN: 978-1118128169

5th edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso