Portland Electronics Companys (PEC) president, Marsha Kunselman, is concerned about the prospects of one of the firms

Question:

Portland Electronics Company’s (PEC) president, Marsha Kunselman, is concerned about the prospects of one of the firm’s major products. The president has been reviewing a marketing report with Jeff Keller, marketing product manager, for their top-of-the-line stereo amplifier. The report indicates another price reduction is needed to meet anticipated competitors’ reductions in sales prices. The current selling price for PEC’s amplifier is $700 per unit. It is expected that within three months PEC’s two major competitors will be selling their comparable amplifiers for $600 per unit. This concerns Kunselman because PEC’s current cost of producing the amplifiers is $630, which yields a $70 profit on each unit sold.

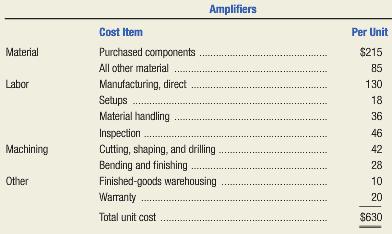

The situation is especially disturbing because PEC had implemented an activity-based costing (ABC) system about two years ago. The ABC system helped them better identify costs, cost pools, cost drivers, and cost reduction opportunities. Changes made when adopting ABC reduced costs on this product by approximately 15 percent during the last two years. Now it appears that costs will need to be reduced considerably more to remain competitive and to earn a profit on the amplifier. Total costs to produce, sell, and service the amplifiers are as follows:

Kunselman has decided to hire Donald Collins, a consultant, to help decide how to proceed. After a value-engineering analysis, Collins suggested that PEC adopt a just-in-time (JIT) cell manufacturing process to help reduce costs. He also suggested that using target costing would help in meeting the new target price. By changing to a JIT cell manufacturing system, PEC expects that manufacturing direct labor will increase by $30 per finished unit. However, setup, material handling, inspection, and finished goods warehousing will all be eliminated. Machine costs will be reduced from $70 to $60 per unit, and warranty costs are expected to be reduced by 40 percent.

Required:

1. Define target costing.

2. Define value engineering.

3. Determine Portland Electronics Company’s unit target cost at the $600 competitive sales price while maintaining the same percentage of profit on sales as is earned on the current $700 sales price.

4. If the just-in-time cell manufacturing process is implemented with the changes in costs noted, will PEC meet the unit target cost you determined in requirement (3)? Prepare a schedule detailing cost reductions and the unit cost under the proposed JIT cell manufacturing process.

Step by Step Answer:

Managerial Accounting Creating Value in a Dynamic Business Environment

ISBN: 978-0078025662

10th edition

Authors: Ronald Hilton, David Platt