Prepare the operating activities section of the statement of cash flows for Pollys Imported Goods in BE22-12

Question:

Prepare the operating activities section of the statement of cash flows for Polly’s Imported Goods in BE22-12 using the indirect method, assuming that Polly reports under IFRS. Polly begins the operating activities section with income before interest and taxes. It reports interest paid in the financing activities section and interest received in the investing activities section.

In BE22-12

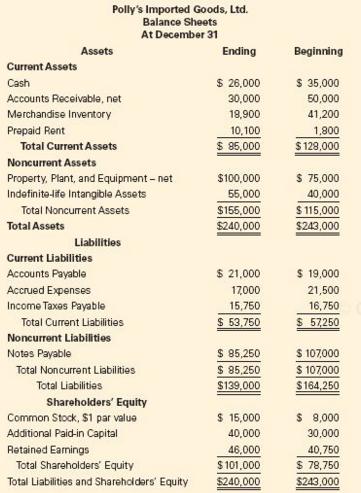

Operating Activities Section, Direct Method. Polly’s Imported Goods, Ltd. recently issued its annual report for the current year. Polly’s comparative balance sheets for the current year are presented below. Prepare the operating activities section of the statement of cash flows using the direct method. Assume accrued expenses relate to selling, general and administrative expenses.

Polly’s Imported Goods, Ltd.

Income Statement

For the Year Ended December 31

Sales…………………………………………………. $ 137,710

Cost of Goods Sold…………………………………. 82,626

Gross Profit………………………………………….. $ 55,084

Selling, General, and Administrative Expenses……… $ 23,584

Depreciation Expense………………………………… 8,000

Total Operating Expenses…………………………….. $ 31,584

Income Before Interest and Taxes…………………..... $ 23,500

Interest Expense………………………………………. $ (6,000)

Income Before Tax……………………………………. $ 17,500

Income Tax Expense………………………………….. (7,000)

Net Income……………………………………………. $ 10,500

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0132162302

1st edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella