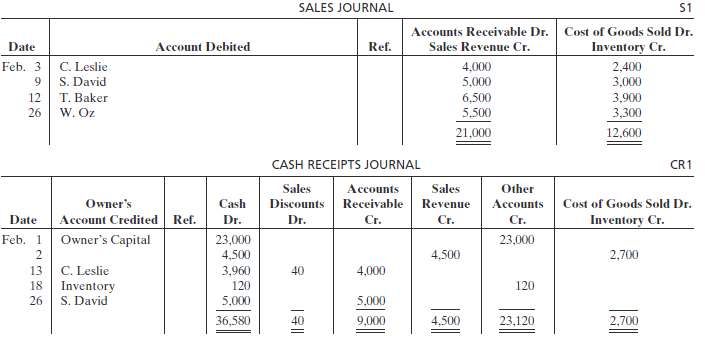

Presented below are the sales and cash receipts journals for Hudson Co. for its first month of

Question:

Presented below are the sales and cash receipts journals for Hudson Co. for its first month of operations.

In addition, the following transactions have not been journalized for February 2012.Feb. 2 Purchased merchandise on account from B. Baumgartner for $3,600, terms 2/10, n/30.7 Purchased merchandise on account from A. Martin for $23,000, terms 1/10, n/30.9 Paid cash of $980 for purchase of supplies.12 Paid $3,528 to B. Baumgartner in payment for $3,600 invoice, less 2% discount.15 Purchased equipment for $5,500 cash.16 Purchased merchandise on account from D. Gale $1,900, terms 2/10, n/30.17 Paid $22,770 to A. Martin in payment of $23,000 invoice, less 1% discount.20 S. Hudson withdrew cash of $800 from the business for personal use.21 Purchased merchandise on account from Kansas Company for $6,000, terms 1/10, n/30.28 Paid $1,900 to D. Gale in payment of $1,900 invoice.Instructions(a) Open the following accounts in the general ledger.101 Cash 301 Owner??s Capital112 Accounts Receivable 306 Owner??s Drawings120 Inventory 401 Sales Revenue126 Supplies 414 Sales Discounts157 Equipment 505 Cost of Goods Sold158 Accumulated Depreciation??Equipment 631 Supplies Expense201 Accounts Payable 7 11 Depreciation Expense(b) Journalize the transactions that have not been journalized in a one-column purchases journal and the cash payments journal (see Illustration 7-16).(c) Post to the accounts receivable and accounts payable subsidiary ledgers. Follow the sequence of transactions as shown in the problem.(d) Post the individual entries and totals to the general ledger.(e) Prepare a trial balance at February 28, 2012.(f) Determine that the subsidiary ledgers agree with the control accounts in the general ledger.(g) The following adjustments at the end of February are necessary.(1) A count of supplies indicates that $200 is still on hand.(2) Depreciation on equipment for February is $150.Prepare the adjusting entries and then post the adjusting entries to the general ledger.(h) Prepare an adjusted trial balance at February 28,2012.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive...

Step by Step Answer:

Accounting Principles

ISBN: 978-0470534793

10th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso