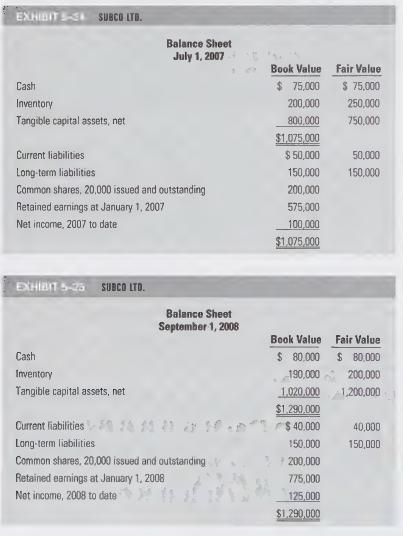

The balance sheet for Subco Ltd. at July 1, 2007, is shown in Exhibit 5-24 On that

Question:

The balance sheet for Subco Ltd. at July 1, 2007, is shown in Exhibit 5-24 On that date, Parco Ltd. purchased 6,000 common shares of Subco for $312,500 and thereby attained significant influence over the affairs of Subco.

Subco amortizes its tangible capital assets over 10 years straight-line. The inventory is expected to turn over six times per year and is on a FIFO cost allocation system.

On September 1, 2008, Parco purchased 3,000 more shares of Subco for $183,500. The balance sheet of Subco and the related fair values are shown in Exhibit 5-25.

Between September 1 and December 31, 2008, Subco had net income of $30,000 and paid no dividends. On January 1, 2009, Parco sold 4,000 of its shares in Subco for $300,000.

Required:

Calculate Parco’s gain or loss on disposal of the Subco shares on January 1, 2009.

Step by Step Answer: