Ahmed carries on business as a general trader. He has not kept proper accounting records and he

Question:

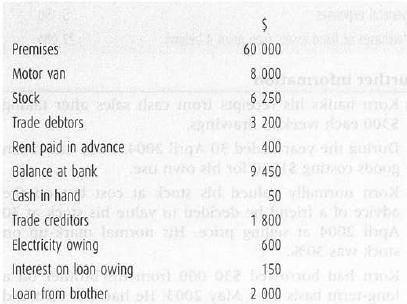

Ahmed carries on business as a general trader. He has not kept proper accounting records and he asks you to help him prepare his Trading and Profit and Loss Account for the year ended 30 September 2004 and his Balance Sheet at that date. Ahmed's assets and liabilities at 30 September 2003 were as follows.

The loan carries interest at 10% per annum payable in arrears annually on 31 December each year.

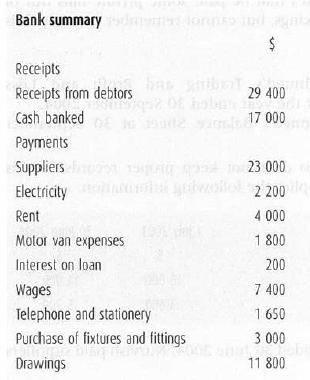

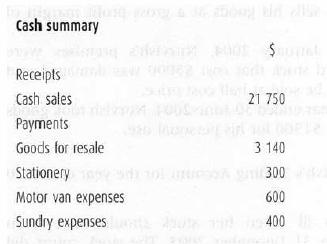

Ahmed's transactions in the year ended 30 September 2004 were as follows.

Further information

1. The balance of cash in hand has been maintained at $50.

2. At 30 September 2004, the closing stock was $8000. Trade debtors were $1600 and trade creditors for supplies were $1300.

3. Bad debts written off in the year were $250.

4. Discounts received from suppliers in the year were $420.

5. At 30 September 2004 electricity owing was $320 and rent of $450 had been prepaid.

6. At 30 September 2004 the motor van was valued at $6000.

7. Fixtures and fittings are to be depreciated on the reducing balance method using the rate of 25% per annum. A full year's depreciation is to be taken in the year ended 30 September 2004.

8. Ahmed does not provide for depreciation on the premises.

9. Ahmed has taken goods costing $800 from the business for his own use during the year.

10. Ahmed states that he paid some private bills out of the cash takings, but cannot remember how much is involved.

Required

(a) Prepare Ahmed's Trading and Profit and Loss Account for the year ended 30 September 2004.

(b) Prepare Ahmed's Balance Sheet at 30 September 2004.

Step by Step Answer: