Cornelius commenced business on 1 April 2002. He has not kept complete records of his transactions but

Question:

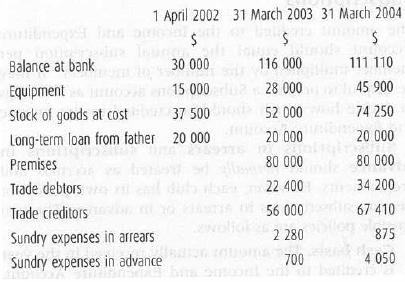

Cornelius commenced business on 1 April 2002. He has not kept complete records of his transactions but he supplies the following information.

Further information

1. Cornelius made payments of $371 340 to suppliers in the year ended 31 March 2004.

2. Complete records of takings are not available but goods are sold at a mark-up of 30%.

3. (i) Takings were banked after deduction of the following. From 1 April 2002 to 31 March 2003, Cornelius drew $400 per week from takings for his personal expenses. From 1 April 2003 the weekly amounts drawn were increased to $500.

(ii) On 1 July 2003, Cornelius paid $5000 out of takings to pay for a family holiday.

(iii) Cornelius has taken various other amounts from takings for personal expenses, but he has not kept a record of these.

4. Cornelius purchased the business premises on 1 October 2002. He paid $40 000 for these from his own private bank account. The balance was obtained as a bank loan on which interest is payable at 15% per annum on 31 December each year.

5. Cornelius father has agreed that his loan to the business will be free of interest for the first year. After that, interest will be at the rate of 8% per annum, payable annually on 31 March.

6. Cornelius purchased additional equipment costing $24 000 in the year ended 31 March 2004.

7. Sundry expenses paid in the year ended 31 March 2004 amounted to $27 000.

Required

(a) Calculate Cornelius' profit or loss for the year ended 31 March 2003.

(b) Prepare in as much detail as possible a Trading and Profit and Loss Account for the year ended 31 March 2004.

(c) Prepare a Balance Sheet as at 31 March 2004.

Step by Step Answer: