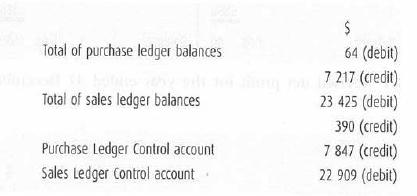

The following information has been extracted from the books of Rorre Ltd at 31 December 2003. Draft

Question:

The following information has been extracted from the books of Rorre Ltd at 31 December 2003.

Draft accounts show a net profit of $31 000 for the year ended 31 December 2003. The following errors have been discovered.

1. An invoice for $100 has been entered twice in the purchases journal.

2. A total of $84 has been omitted from both the Discounts Received account and the Purchase Ledger Control account.

3. A debit balance of $50 has been entered in the list of purchase ledger balances as a credit balance.

4. An amount of $710 owing to Trazom, a supplier, has been offset against their account in the sales ledger, but no entry has been made in the Control accounts.

5. An invoice in the sales journal for $326 has been entered in the sales ledger as $362.

6. The sales journal total for December has been understated by $800.

Required

(a) Prepare a statement to show the corrected purchase and sales ledger balances.

(b) Prepare corrected Purchase and Sales Ledger Control accounts.

(c) Calculate the amended net profit for the year ended 31 December 2003.

(d) Prepare a Balance Sheet extract at 31 December 2003 to show the debtors and creditors.

Step by Step Answer: