Ambulators Limited makes prams and pushchairs. The company is currently evaluating two projects that are competing for

Question:

Ambulators Limited makes prams and pushchairs. The company is currently evaluating two projects that are competing for investment funds.

The first project is the introduction to the market of a new pram. The new pram will require an initial investment of £3,300,000 in marketing and enhanced production facilities and each new pram will sell for £450 over the life of the product. Market research has shown that demand for the new pram is expected to be 5,000 units in the first year of production, with demand rising by 20% per annum on the previous year’s sales in years 2 to 5. At the end of year 5, a new improved pram will have entered production and the investment in the new pram will have a residual value of £Nil.

The second project is a new pushchair. This will require an initial outlay on marketing and enhanced production facilities of £2,200,000. Each new pushchair will sell initially in the first year of production and sales for £220, but the directors expect the price to rise by £10 each year in each of years 2 to 5. Market research has projected that initial demand will be for 6,000 pushchairs in year 1 and that demand will rise by 10% per annum on the previous year’s sales in years 2 to 5. At the end of year 5, the production facilities will be used to produce a new pushchair and will be transferred to the new project at a valuation of £500,000. Both projects are competing for the same capital resources and only one of the projects can be undertaken by the company.

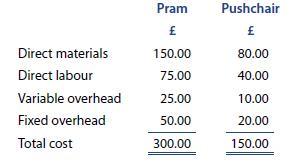

The cost card for the new pram and the new pushchair are as follows:

Fixed production overhead allocated to the cost of each product is based on 5,000 units of production for prams and 6,000 units of production for pushchairs. Fixed costs do not include depreciation of the new investment in each project. Ambulators Limited has a cost of capital of 11%.

Required

For the proposed investment in the new pram or pushchair, calculate for each project:

• The payback period

• The ARR

• The NPV

• The IRR

You should round your sales projections to the nearest whole unit of sales.

The directors would like to hear your views on which project they should accept. Your advice should take into account both the financial aspects of the decision and any other factors that the directors of Ambulators Limited should consider when deciding which project to invest in.

Step by Step Answer: