Chillers plc manufactures fridges and freezers. The company is considering the production of a new deluxe fridge-freezer.

Question:

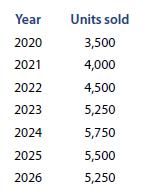

Chillers plc manufactures fridges and freezers. The company is considering the production of a new deluxe fridge-freezer. The fridge-freezer will sell for £600 and the company’s marketing department has produced a forecast for sales for the next seven years as follows:

Variable costs are budgeted to be 40% of selling price. Fixed costs arising from the sale and production of the new deluxe fridge-freezer are expected to be £1,200,000 per annum. Fixed costs exclude depreciation of the new investment.

As a result of the introduction of the new deluxe fridge-freezer, the company expects to lose sales of 2,000 standard fridge-freezers each year over the next seven years. These standard fridge-freezers sell for £350 each with variable costs of 35% of selling price. The reduction in sales of standard fridge-freezers will save cash expenditure on fixed costs of £395,000 per annum.

The initial expenditure on the production line for the new deluxe fridge-freezer has been estimated at £2,000,000. At the end of seven years, this production line will have a scrap value of £100,000.

Chillers plc has a required rate of return on new investment of 13%.

Required

For the proposed investment in the new deluxe fridge-freezer, calculate:

• The payback period

• The ARR

• The NPV

• The IRR

Advise the directors of Chillers plc whether the project should go ahead or not.

Step by Step Answer: