Chester Constructions is an engineering consulting firm specialising in the installation of electronic communications systems. The company

Question:

Chester Constructions is an engineering consulting firm specialising in the installation of electronic communications systems. The company is considering the purchase of testing equipment that will be used on jobs. The equipment will cost $1 740 000 and will have no residual value at the end of its 6-year life.

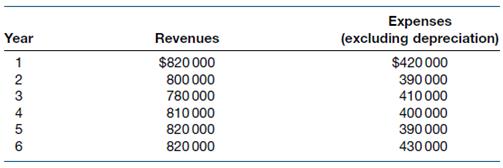

The firm’s accountant projects revenue and expenses with the operation of the equipment that are equal to the cash inflows and cash outflows associated with it, except for depreciation. A summary of the cash flows expected from the equipment (without considering taxes) is as follows.

Assume the company’s cost of capital is 12% and its expected tax rate is 30%.

Required

(a) Calculate the return on average investment for the equipment.

(b) Determine the annual net cash inflows (after tax) expected from the operation of the equipment.

(c) Calculate the net present value for the investment.

(d) Determine the net present value index for the investment.

(e) Should the testing equipment be purchased? Explain why.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie