Medrano Ltd is a furniture manufacturer. The company is looking at three alternative specialised machines to replace

Question:

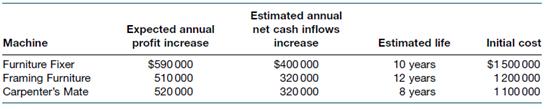

Medrano Ltd is a furniture manufacturer. The company is looking at three alternative specialised machines to replace its existing production line. Data for each of the machines are as follows.

The company’s cost of capital is 12%.

Required

(a) Rank the three machines using each of the following methods:

i. net present value method ii. net present value index iii. payback period iv. return on average investment.

(b) Comment on the rankings under the four methods of evaluating the machines and explain which method would provide the best result for the firm and why payback period or return on average investment might be preferred by Medrano Ltd.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie