Part A Booker Ltd balances its accounts at month-end, using special journals, and the perpetual inventory system

Question:

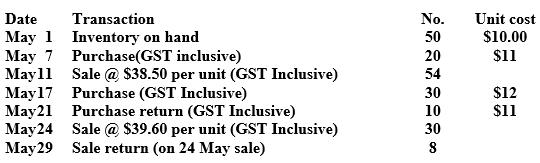

Part A Booker Ltd balances its accounts at month-end, using special journals, and the perpetual inventory system with the FIFO cost flow assumption. All purchases and sales of inventory are made on credit. The end of the reporting period is 30 June. Ignore GST. Sales and purchases of product JINX-87 in May 2024 were as follows:

Required For product JINX-87, calculate the cost of sales for the month of May and the cost of inventory on hand at 31 May 2024 using an inventory stockcard.

Part B The inventory ledger account balance at 30 June 2024 was \($7650\), and net realisable value for each product line exceeded cost. The cost of inventory on hand at 30 June 2024 determined by physical count, however, was only \($7578\). In investigating the reasons for the discrepancy, Booker Ltd discovered the following.

• Goods costing \($87\) were sold for \($100\) on 26 June 2024 on DDP shipping terms. The goods were in transit at 30 June 2024. The sale was recorded on 26 June 2024 and the goods were not included in the physical count.

• Goods costing \($90\) were ordered on 24 June 2024 on EXW shipping terms. The goods were delivered to the transport company on 27 June 2024. The purchase was recorded on 27 June 2024 but, as the goods had not yet arrived, the goods were not included in the physical count.

• Goods costing \($140\) held on consignment for Good Buys Ltd were included in the physical count.

Required

(a) Prepare any journal entries required on 30 June 2024 to correct error(s) and to adjust the inventory account (Use the general journal).

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie