The following information was extracted from the accounting records of the business of Matts Home Maintenance Services:

Question:

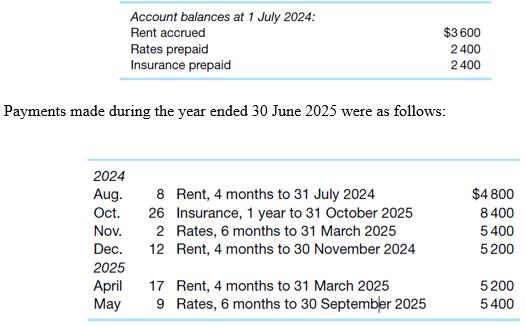

The following information was extracted from the accounting records of the business of Matt’s Home Maintenance Services:

Assume that whenever cash was paid, the debit entry was made to the appropriate expense account, rather than the asset or liability, for the year. The only exception to this is the first payment for the year which is split between the accrual or deferral and the expense.

Required

(a) Write up and balance the Rent Payable, Prepaid Rates, and Prepaid Insurance accounts in the ledger of Matt’s Home Maintenance Services for the year 1 July 2024 to 30 June 2025.

(b) Show clearly any adjusting entries that may be required on 30 June 2025. Explain why these adjusting entries are necessary

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie