Refer to the previous question. What amount of tax revenues should be recorded in the Revenues Subsidiary

Question:

Refer to the previous question. What amount of tax revenues should be recorded in the Revenues Subsidiary Ledger for the transaction?

a. $744,310.

b. $759,500.

c. $775,000.

d. None of the above-revenues should only be reported in the Revenues Subsidiary Ledger as the cash is actually received.

Data from the previous Question

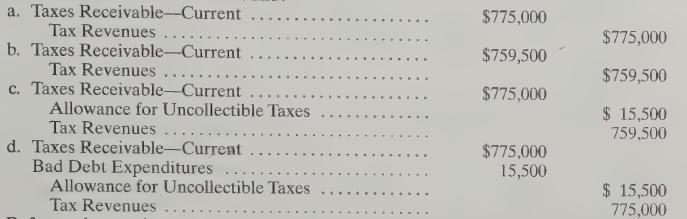

Assume that Nathan County has levied its current year taxes and all revenue recognition criteria for property taxes have been met. The amount levied was $775,000, of which 2% is deemed to be uncollectible (based on historical experience). Which of the following entries would be made in the General Fund?

Step by Step Answer:

Governmental And Nonprofit Accounting Theory And Practice

ISBN: 9780132552721

9th Edition

Authors: Robert J Freeman, Craig D Shoulders, Gregory S Allison, Terry K Patton, Robert Smith,