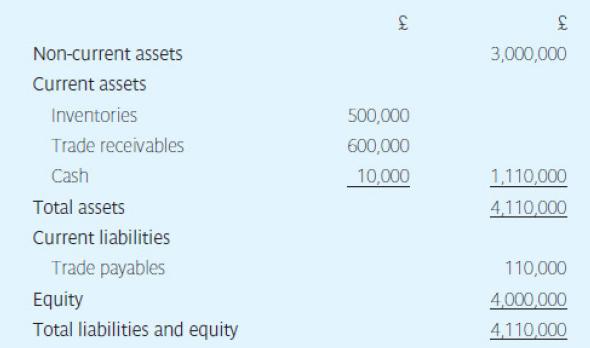

The summarized statement of financial position of the Warmel Trading Company as at 31 December last year

Question:

The summarized statement of financial position of the Warmel Trading Company as at 31 December last year was as follows:

Last year sales amounted to £3,600,000 and net profit before tax was £600,000. The company’s target ROCE is 15 per cent. It is estimated that variable costs amount to 50 per cent of sales, and that non-current costs amount to £1,200,000 per annum.

The purchasing manager is concerned about the very small amount of cash available and that the company may be unable to meet its current liabilities as they fall due.

The financial accountant says that the level of receivables is too high, and proposes to appoint a credit controller at an annual cost of £25,000. He reckons that by doing this the amount of receivables could be halved.

The sales manager believes that many customers are put off by the strict credit control policies, and would like to allow three months’

credit to customers. If this policy was adopted he reckons that sales would increase by at least 10 per cent. The finance director estimates that such a policy would result in receivables taking, on average, four months to pay, that inventory and payables would each increase by 10 per cent, and that bad debts would increase by

£18,000 per annum.

Required:

a Evaluate the comments made by:

i the purchasing manager;

ii the financial accountant;

iii the sales manager and finance director.

b What would be your recommendation and why?

Step by Step Answer: