As indicated in the All About You feature in this chapter, any Canadian aged 18 or older

Question:

As indicated in the “All About You” feature in this chapter, any Canadian aged 18 or older can save up to $6,000 every year in a tax-free savings account (TFSA). TFSA savings can be used for any purpose, including for a vacation, to buy a car, or to start a small business. The goal of TFSAs is to allow Canadians to save more and achieve their goals quicker.

Instructions

a. Do a search on TFSAs and RRSPs. What are the similarities and differences between the two savings options?

b. Go to www.cra-arc.gc.ca/tfsa/ and click on the link “Types of investments.” Note that the government allows a variety of investment options, including equity securities listed on a stock exchange and bonds. What types of investment income will you earn on equity securities? Bonds? What might be the benefits of investing in equity securities? The risks?

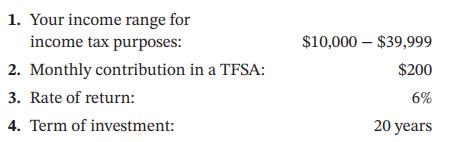

c. All of the banks in Canada provide a TFSA calculator where you can determine the amount of tax savings from a contribution. Do a search for “TFSA calculator” and select a banking website of your choice. Assume the following information:

How much more will you save in a TFSA than in a taxable savings account? If you are using a TSFA calculator that requires a single amount instead of a range, use the amount at the high end of the range given.

d. Assume the same as in part (c) except assume that your income range for income tax purposes is $40,000 to $79,999. How much more will you save in a TFSA than in a taxable account?

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak