The trial balances of two proprietorships on January 1 of the current year: Visanji and Vanbakel decide

Question:

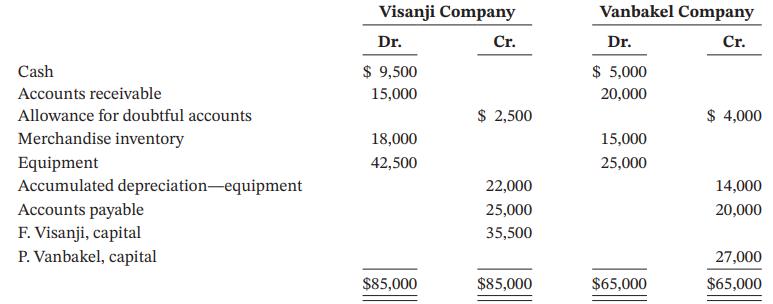

The trial balances of two proprietorships on January 1 of the current year:

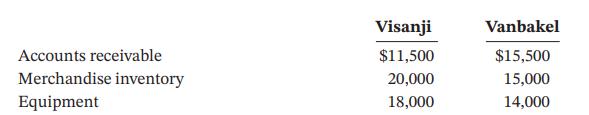

Visanji and Vanbakel decide to form the Varsity partnership and agree on the following fair values for the noncash assets that each partner is contributing:

All of the assets in the two proprietorships will be transferred to the partnership on January 1. The partnership will also assume all the liabilities of the two proprietorships. Further, it is agreed that Vanbakel will invest the amount of cash required so her investment in the partnership is equal to Visanji’s.

Instructions

a. What are the advantages and disadvantages for these two individuals of forming a partnership as opposed to setting up a corporation?

b. Prepare separate journal entries to record the transfer of each proprietorship’s assets and liabilities to the partnership on January 1.

c. Journalize the additional cash investment.

d. Prepare a balance sheet for the partnership as at January 1, 2024.

What are some of the advantages of two individuals such as Visanji and Vanbakel operating their businesses as a partnership instead of as two separate proprietorships?

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak