1. Coy Corporation and its divisions are engaged solely in manufacturing operations. The following data (consistent with...

Question:

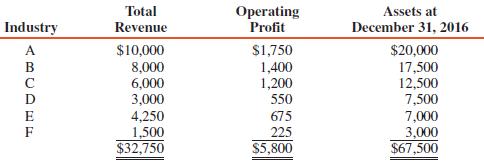

1. Coy Corporation and its divisions are engaged solely in manufacturing operations. The following data (consistent with prior years’ data) pertain to the industries in which operations were conducted for the year ended December 31, 2016 (in thousands):

In its segment information for 2016, how many reportable segments does Coy have?

a Three

b Four

c Five

d Six

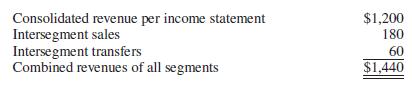

2. Hen Corporation’s revenues for the year ended December 31, 2016, are as follows (in thousands):

Hen has a reportable segment if that segment’s revenues exceed:

a $6

b $24

c $120

d $144

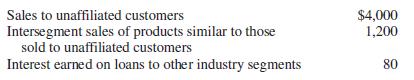

3. The following information pertains to Ari Corporation and its divisions for the year ended December 31, 2016 (in thousands):

The intersegment interest is not reported by the divisions on internal reports reviewed by the chief operating officer. Ari and all of its divisions are engaged solely in manufacturing operations. Ari has a reportable segment if that segment’s revenue exceeds:

a $528

b $520

c $408

d $400

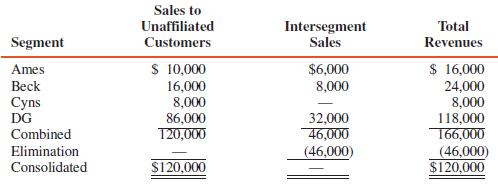

4. The following information pertains to revenue earned by Wig Company’s operating segments for the year ended December 31, 2016:

In conformity with the revenue test, Wig reportable segments were:

a Only DG

b Beck and DG

c Ames, Beck, and DG

d Ames, Beck, Cyns, and DG

Use the following information in answering questions 5 and 6:

Gum Corporation, a publicly owned corporation, is subject to the requirements for segment reporting. In its income statement for the year ended December 31, 2016, Gum reported revenues of $50,000,000, operating expenses of $47,000,000, and net payroll costs of $15,000,000. Gum’s combined identifiable assets of all industry segments at December 31, 2016, were $40,000,000.

5. In its 2016 financial statements, Gum should disclose major customer data if sales to any single customer amount to at least:

a $300,000

b $1,500,000

c $4,000,000

d $5,000,000

6. In its 2016 financial statements, if Gum is organized on an industry basis, it should disclose foreign operations data on a specific country if revenues from that country’s operations are at least:

a $5,000,000

b $4,700,000

c $4,000,000

d $1,500,000

7. Selected data for a segment of a business enterprise are to be separately reported in accordance with GAAP when the revenues of the segment exceed 10 percent of the:

a Combined net income of all segments reporting profits

b Total revenues obtained in transactions with outsiders

c Total revenues of all the enterprise’s operating segments

d Total combined revenues for all segments reporting profits

8. In financial reporting of segment data, which of the following items is used in determining a segment’s operating income?

a Income tax expense

b Sales to other segments

c General corporate expense

d Gain or loss on discontinued operations

Step by Step Answer:

Advanced Accounting

ISBN: 978-0134472140

13th edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith