Part I Mindy Feldkamp and her two colleagues, Oscar Lopez and Lori Melton, are personal trainers at

Question:

Part I Mindy Feldkamp and her two colleagues, Oscar Lopez and Lori Melton, are personal trainers at an upscale health spa/resort in Tampa, Florida. They want to start a health club that specializes in health plans for people in the 501 age range. The growing population in this age range and strong consumer interest in the health benefits of physical activity have convinced them they can profitably operate their own club. In addition to many other decisions, they need to determine what type of business organization they want. Oscar believes there are more advantages to the corporate form than a partnership, but he hasn’t yet convinced Mindy and Lori. They have come to you, a small-business consulting specialist, seeking information and advice regarding the choice of starting a partnership versus a corporation.

Instructions

(a) Prepare a memo (dated May 26, 2011) that describes the advantages and disadvantages of both partnerships and corporations. Advise Mindy, Oscar, and Lori regarding which organizational form you believe would better serve their purposes. Make sure to include reasons supporting your advice.

Part II After deciding to incorporate, each of the three investors receives 20,000 shares of $2 par common stock on June 12, 2011, in exchange for their co-owned building ($200,000 fair value) and $100,000 total cash they contributed to the business. The next decision that Mindy, Oscar, and Lori need to make is how to obtain financing for renovation and equipment. They understand the difference between equity securities and debt securities, but do not understand the tax, net income, and earnings per share consequences of equity versus debt financing on the future of their business.

Instructions

(b) Prepare notes for a discussion with the three entrepreneurs in which you will compare the consequences of using equity versus debt financing. As part of your notes, show the differences in interest and tax expense assuming $1,400,000 is financed with common stock, and then alternatively with debt. Assume that when common stock is used, 140,000 shares will be issued. When debt is used, assume the interest rate on debt is 9%, the tax rate is 32%, and income before interest and taxes is $300,000. (You may want to use an electronic spreadsheet.)

Part III During the discussion about financing, Lori mentions that one of her clients, Roberto Marino, has approached her about buying a significant interest in the new club. Having an interested investor sways the three to issue equity securities to provide the financing they need. On July 21, 2011, Mr. Marino buys 90,000 shares at a price of $10 per share.

The club, LifePath Fitness, opens on January 12, 2012, and after a slow start, begins to produce the revenue desired by the owners. The owners decide to pay themselves a stock dividend, since cash has been less than abundant since they opened their doors. The 10% stock dividend is declared by the owners on July 27, 2012. The market price of the stock is $3 on the declaration date. The date of record is July 31, 2012 (there have been no changes in stock ownership since the initial issuance), and the issue date is August 15, 2012. By the middle of the fourth quarter of 2012, the cash flow of LifePath Fitness has improved to the point that the owners feel ready to pay themselves a cash dividend. They declare a $0.05 cash dividend on December 4, 2012. The record date is December 14, 2012, and the payment date is December 24, 2012.

Instructions

(c) (1) Record all of the transactions related to the common stock of LifePath Fitness during the years 2011 and 2012. (2) Indicate how many shares are issued and outstanding after the stock dividend is issued.

Part IV Since the club opened, a major concern has been the pool facilities. Although the existing pool is adequate, Mindy, Oscar, and Lori all desire to make LifePath a cutting-edge facility. Until t

he end of 2012, financing concerns prevented this improvement. However, because there has been steady growth in clientele, revenue, and income since the fourth quarter of 2012, the owners have explored possible financing options. They are hesitant to issue stock and change the ownership mix because they have been able to work together as a team with great effectiveness. They have formulated a plan to issue secured term bonds to raise the needed $600,000 for the pool facilities. By the end of April 2013, everything was in place for the bond issue to go ahead. On June 1, 2013, the bonds were issued for $548,000. The bonds pay semiannual interest of 3 (6% annual) on December 1 and June 1 of each year. The bonds mature in 10 years, and amortization is computed using the straight-line method.

Instructions

(d) Record (1) the issuance of the secured bonds, (2) the interest payment made on December 1, 2013, (3) the adjusting entry required at December 31, 2013, and (4) the interest payment made on June 1, 2014.

Part V Mr. Marino’s purchase of the stock of LifePath Fitness was done through his business. The stock investment has always been accounted for using the cost method on his firm’s books. However, early in 2014 he decided to take his company public. He is preparing an IPO (initial public offering), and he needs to have the firm’s financial statements audited. One of the issues to be resolved is to restate the stock investment in LifePath Fitness using the equity method, since Mr. Marino’s ownership percentage is greater than 20%.

Instructions

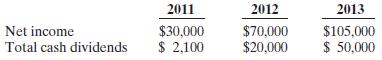

(e) (1) Give the entries that would have been made on Marino’s books if the equity method of accounting for investments had been used since the initial investment. Assume the following data for LifePath.

(2) Compute the balance in the Stock Investment account (as it relates to LifePath Fitness) at the end of 2013.

Step by Step Answer:

Accounting Principles

ISBN: 978-0470534793

10th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso