A Co has as its functional currency the Singapore dollar (S$) and enters into the following transaction.

Question:

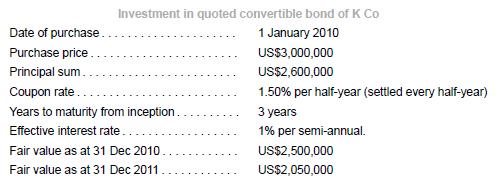

A Co has as its functional currency the Singapore dollar (S$) and enters into the following transaction. The business model of A Co is to hold investments to collect contractual cash flows and for sale.

Fair values of option in convertible bond remain unchanged on 31 December 2010 and 31 December 2011. A Co enters into an interest rate swap with an external party B Co in an attempt to hedge the fixed rate convertible bond purchased on 1 January 2010. In the interest rate swap contract, A Co receives floating interest rate LIBOR +

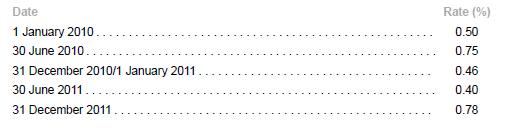

1%, reset and receivable every six months and pays fixed rate 1.50% semi-annually. Notional principal of the swap is US$3,000,000 and the swap maturity date is 31 December 2012. Swap settlements are made at the end of each half-year and the LIBOR rates are reset at the beginning of each half-year. The sixmonth LIBOR rates are as follows:

Required

Prepare the journal entries in A Co’s book in relation to the swap from 1 January 2010 to 31 December 2011.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah