Baker Company acquires an 80%interest in the common stock of Cain Company for $440,000 on January 1,

Question:

Baker Company acquires an 80%interest in the common stock of Cain Company for $440,000 on January 1, 2015. The price is equal to the book value of the interest acquired. Baker Company maintains its investment in Cain Company under the cost method.

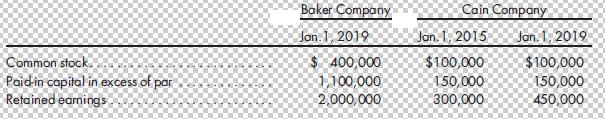

Able Company acquires a 60% interest in the common stock of Baker Company on January 1, 2019, for $2,700,000. Any excess of cost is attributable to Cain Company equipment, which is understated by $80,000, and a Baker Company building, which is understated by $200,000. Any remaining excess is considered goodwill. Relevant stockholders’ equities are as follows:

1. Prepare a determination and distribution of excess schedule for Able Company’s investment in Baker Company.

2. On January 1, 2020, Cain Company sells a machine with a net book value of $35,000 to Able Company for $60,000. The machine has a 5-year life. Prepare the eliminations and adjustments needed on the December 31, 2021, trial balance worksheet that relate to this intercompany sale.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng