Kiln Corporation is considering the acquisition of Williams Incorporated. Kiln has asked you, its accountant, to evaluate

Question:

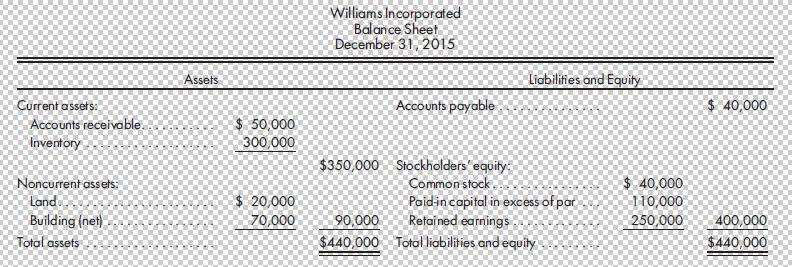

Kiln Corporation is considering the acquisition of Williams Incorporated. Kiln has asked you, its accountant, to evaluate the various offers it might make to Williams Incorporated. The December 31, 2015, balance sheet of Williams is as follows:

The following fair values differ from existing book values:

Required

Record the acquisition entry for Kiln Corporation that would result under each of the alternative offers. Value analysis is suggested.

1. Kiln Corporation issues 20,000 of its $10 par common stock with a fair value of $25 per share for the net assets of Williams Incorporated.

2. Kiln Corporation pays $385,000 in cash.

Step by Step Answer:

To evaluate the acquisition and record the necessary journal entries we must first understand the concept of fair value adjustments The fair value adj...View the full answer

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng

Students also viewed these Business questions

-

Kiln Corporation is considering the acquisition of Williams Incorporated. Kiln has asked you, its accountant, to evaluate the various offers it might make to Williams Incorporated. The December 31,...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

At what value of x is there an infinite discontinuity?

-

Refer to Figure 14.3. Select a year when the gallons of oil spilled were over 15 million. Research the spill(s) for that year. Was the amount due to one oil spill or multiple oil spills?Investigate...

-

Your comparison of the gross margin percent for Jones Drugs for the years 2008 through 2011 indicates a significant decline. This is shown by the following information: A discussion with Marilyn...

-

Coca-Cola and Pepsi both advertise aggressively, but would they be better off if they didn't? Their commercials are usually not designed to convey new information about their products. Instead, they...

-

The data set at the left lists the numbers of text messages sent in one day by 50 cell phone users. Display the data in a stem-and-leaf plot. Describe any patterns. Number of Text Messages Sent 76 49...

-

The Italian Bread Company purchased land as a factory site for $ 70,000. An old building on the property was demolished, and construction began on a new building. Costs incurred during the first year...

-

Masons Masons is a professional accounting and consultancy firm specialising in audit, tax and consultancy services, operating in three main offices located in Melbourne, Sydney and Auckland. Masons...

-

Moon Company is contemplating the acquisition of Yount, Inc., on January 1, 2015. If Moon acquires Yount, it will pay $730,000 in cash to Yount and acquisition costs of $20,000. The January 1, 2015,...

-

Jack Company is a corporation that was organized on July 1, 2015. The June 30, 2020, balance sheet for Jack is as follows: The experience of other companies over the last several years indicates that...

-

Reaction review II. Without consulting the Reaction Road Map on p. 818, suggest reagents to convert cyclohexanone into each of the compounds below. -5 -8 - OH CH2CH3 CN (b) () (d) N(CH,CH,), () (f)...

-

Suppose you have USD 100,000 and you think there is a locational arbitrage in the USD/PHP spot market given quotes of the three banks. Determine the best USD gains (if any), otherwise write 0. (3)...

-

In what ways do socio-cultural factors impact the efficacy of intercultural communication exchanges ?

-

The photo below shows a steady water jet coming from a 5.5-mm diameter nozzle. The water from the jet fills a 900-mL beaker in 35 seconds. Estimate the speed of the water at the nozzle. Indicate any...

-

2. Correct the mistakes in the HTML code given below Page Title This is a Heading This is a paragraph. Corrected Code

-

Suppose a polycrystalline steel sample with an average grain diameter of 65 microns has a yield strength of 135 MPa. The yield strength of the same steel material is doubled when it has an average...

-

In terms of preventing payroll fraud, why is it important for hiring and wage rate changes to be administered through a centralized and independent human resources department?

-

SBS Company have received a contract to supply its product to a Health Care Service Hospital. The sales involve supplying 1,250 units every quarter, the sales price is RM 85 per unit. The Client...

-

The village of Fay was recently incorporated and began financial operations on July 1, 2018, the beginning of its fiscal year. The following transactions occurred during this first fiscal year from...

-

The following information relates to Carson City during its fiscal year ended December 31, 2019: a. On October 31, 2019, to finance the construction of a city hall annex, Carson issued 8%, 10-year...

-

The following information relates to Dell City, whose first fiscal year ended December 31, 2019. Assume Dell has only the long-term debt as specified below and only the funds necessitated by the...

-

Pietro Frozen Foods, Inc., produces frozen pizzas. For next year, Pietro predicts that 50,000 units will be produced, with the following total costs: Direct materials Direct labor Variable overhead...

-

You will complete two case studies over the course of the semester. These are to be completed individually. Each case study is found in the textbook and there are questions there to help guide your...

-

Thanasi has a business snowplowing. He uses a 2018 Ford Rapture with a snowplow outfitted to it. While plowing a driveway, he negligently ran it into the side of the neighbour's house. The damage to...

Study smarter with the SolutionInn App