Moon Company is contemplating the acquisition of Yount, Inc., on January 1, 2015. If Moon acquires Yount,

Question:

Moon Company is contemplating the acquisition of Yount, Inc., on January 1, 2015. If Moon acquires Yount, it will pay $730,000 in cash to Yount and acquisition costs of $20,000.

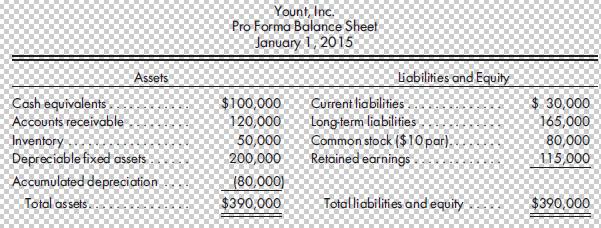

The January 1, 2015, balance sheet of Yount, Inc., is anticipated to be as follows:

Fair values agree with book values except for the inventory and the depreciable fixed assets, which have fair values of $70,000 and $400,000, respectively.

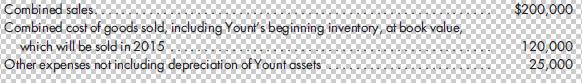

Your projections of the combined operations for 2015 are as follows:

Depreciation on Yount fixed assets is straight-line using a 20-year life with no salvage value.

Required

1. Prepare a value analysis for the acquisition and record the acquisition.

2. Prepare a pro forma income statement for the combined firm for 2015. Show supporting calculations for consolidated income. Ignore tax issues.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng