Kraus Company has the following balance sheet on July 1, 2016: On July 1, 2016, Neiman Company

Question:

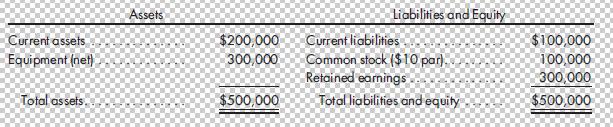

Kraus Company has the following balance sheet on July 1, 2016:

On July 1, 2016, Neiman Company purchases 80% of the outstanding common stock of Kraus Company for $310,000. Any excess of book value over cost is attributed to the equipment, which has an estimated 5-year life. Kraus Company closes its books before the acquisition on July 1.

On December 31, 2016, Neiman Company and Kraus Company prepare the following trial balances:

1. Prepare a determination and distribution of excess schedule for the investment (a value analysis is not needed).

2. Prepare all the eliminations and adjustments that would be made on the December 31, 2016, consolidated worksheet.

3. Prepare the 2016 consolidated income statement and its related income distribution schedules.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng