Lucky Jim plc has the opportunity to manufacture a particular type of self-tapping screw, for a client

Question:

Lucky Jim plc has the opportunity to manufacture a particular type of self-tapping screw, for a client company, that would become indispensable in a particular niche market in the engineering field. Development of the product requires an initial investment of £200,000 in the project. It has been estimated that the project will yield cash returns before interest of £35,000 per annum in perpetuity. Lucky Jim plc is financed by equity and loans, which are always maintained as two-thirds and one-third of the total capital respectively. The cost of equity is 18% and the pre-tax cost of debt is 9%. The corporation tax rate is 40%. You are required to:

(i) Calculate the cost of the debt for Normal plc

(ii) calculate the weighted average cost of capital for Normal plc using the cost of equity calculated in Exercise E9.1

(ii) if Normal plc has an ordinary capital of 300,000 £1 shares

(iii) comment on the impact on a company’s cost of capital of changes in the rate of corporation tax

(iv) Calculate Normal plc’s WACC if the rate of corporation tax were increased to 50%.

If Lucky Jim plc’s WACC is used as the cost of capital to appraise the project, should the project be undertaken?

DATA Exercise E9.1

A critically important factor required by a company to make financial decisions, for example, the evaluation of investment proposals and the financing of new projects, is its cost of capital. One of the elements included in the calculation of a company’s cost of capital is the cost of equity.

( i) Explain in simple terms what is meant by the ‘cost of equity capital’ for a company.

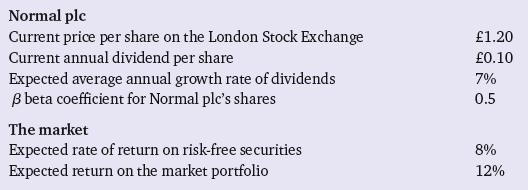

The relevant data for Normal plc and the market in general are given below.

(ii) Calculate the cost of equity capital for Normal plc, using two alternative methods:

(a) the Capital Asset Pricing Model (CAPM)

(b) a dividend growth model of your choice.

Step by Step Answer: