Normal plc pays 20,000 a year interest on an irredeemable debenture, which has a nominal value of

Question:

Normal plc pays £20,000 a year interest on an irredeemable debenture, which has a nominal value of £200,000 and a market value of £160,000. The rate of corporation tax is 30%. You are required to:

(i) Calculate the cost of the debt for Normal plc (ii) calculate the weighted average cost of capital for Normal plc using the cost of equity calculated in Exercise E9.1

(ii) if Normal plc has an ordinary capital of 300,000 £1 shares

(iii) comment on the impact on a company’s cost of capital of changes in the rate of corporation tax

(iv) Calculate Normal plc’s WACC if the rate of corporation tax were increased to 50%.

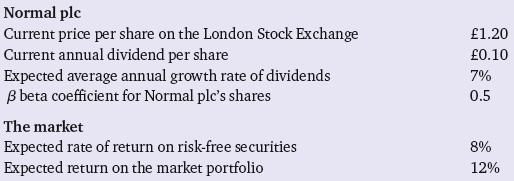

DATA Exercise E9.1

A critically important factor required by a company to make financial decisions, for example, the evaluation of investment proposals and the financing of new projects, is its cost of capital. One of the elements included in the calculation of a company’s cost of capital is the cost of equity.

( i) Explain in simple terms what is meant by the ‘cost of equity capital’ for a company.

The relevant data for Normal plc and the market in general are given below.

Step by Step Answer: