On January 1, 20X1, Prize Corporation paid Morton Advertising $116,200 to acquire 70 percent of Statue Companys

Question:

On January 1, 20X1, Prize Corporation paid Morton Advertising $116,200 to acquire 70 percent of Statue Company’s stock. Prize also paid $45,000 to acquire $50,000 par value 8 percent, 10-year bonds directly from Statue on that date. This purchase represented one-half of the bonds that were originally issued. Interest payments are made on January 1 and July 1. The fair value of the noncontrolling interest at January 1, 20X1, was $49,800, and book value of Statue’s net assets was $110,000. The book values and fair values of Statue’s assets and liabilities were equal except for buildings and equipment, which had a fair value $56,000 higher than book value and a remaining economic life of 14 years at January 1, 20X1.

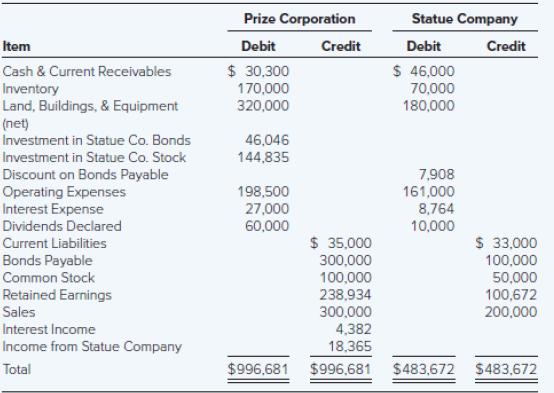

The trial balances for the two companies as of December 31, 20X3, are as follows:

On July 1, 20X2, Statue sold land that it had purchased for $17,000 to Prize for $25,000. Prize continues to hold the land at December 31, 20X3. Assume Prize Corporation uses the fully adjusted equity method.

Required

a. Record the journal entries for 20X3 on Prize’s books related to its investment in Statue’s stock and bonds.

b. Record the entries for 20X3 on Statue’s books related to its bond issue.

c. Prepare consolidation entries needed to complete a worksheet for 20X3.

d. Prepare a three-part consolidation worksheet for 20X3.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd