Penn Company leased a production machine to its 80%-owned subsidiary, Smith Company. The lease agreement, dated January

Question:

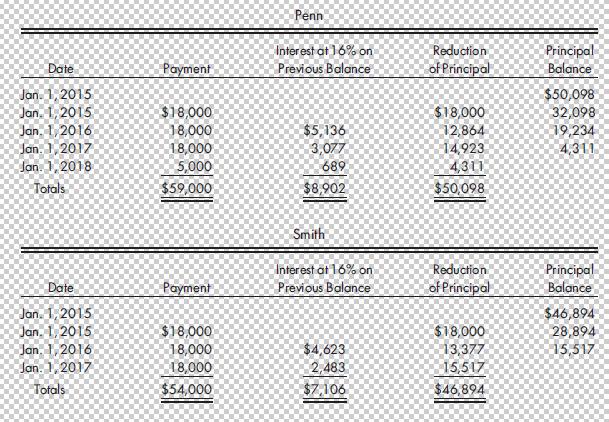

Penn Company leased a production machine to its 80%-owned subsidiary, Smith Company. The lease agreement, dated January 1, 2015, requires Smith to pay $18,000 each January 1 for three years. There is an unguaranteed residual value of $5,000. The machine cost $50,098. The present value of the machine at Penn’s 16% implicit interest rate was $50,098 on January 1, 2015. Smith also uses the 16% lessor implicit rate to record the lease. The machine is being depreciated over three years on a straight-line basis with a $5,000 salvage value. Lease payment amortization schedules are as follows:

Required

1. Prepare the eliminations and adjustments required for this lease on the December 31, 2015, consolidated worksheet.

2. Prepare the eliminations and adjustments for the December 31, 2016, consolidated worksheet.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng