Police Corporation purchased 70 percent of Station Companys voting shares on January 1, 20X4, at underlying book

Question:

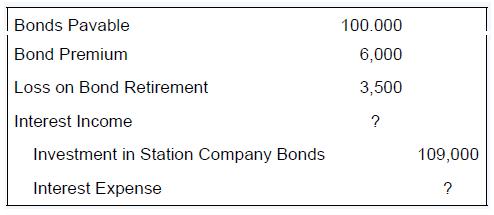

Police Corporation purchased 70 percent of Station Company’s voting shares on January 1, 20X4, at underlying book value. On that date it also purchased $100,000 par value 12 percent Station bonds, which had been issued on January 1, 20X1, with a 10-year maturity. During preparation of the consolidated financial statements for December 31, 20X4, the following consolidation entry was made in the worksheet:

Required

a. What price did Police pay to purchase the Station bonds?

b. What was the carrying amount of the bonds on Station’s books on the date of purchase?

c. If Station reports net income of $30,000 in 20X5, what amount of income should be assigned to the noncontrolling interest in the 20X5 consolidated income statement?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd