Refer to the preceding facts for Presss acquisition of Simon common stock. Press uses the simple equity

Question:

Refer to the preceding facts for Press’s acquisition of Simon common stock. Press uses the simple equity method to account for its investment in Simon. On January 1, 2016, Press held merchandise acquired from Simon for $10,000. During 2016, Simon sold $40,000 worth of merchandise to Press. Press held $12,000 of this merchandise at December 31, 2016. Press owed Simon $6,000 on December 31 as a result of this intercompany sale. Simon has a gross profit rate of 25%.

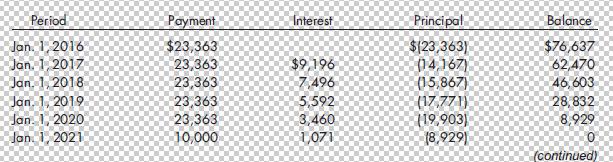

On January 1, 2016, Simon signed a 5-year lease with Press for the rental of equipment, which has a 5-year life. Payments of $23,363 are due each January 1, and there is a guaranteed residual value of $10,000 at the end of the five years. The market value of the equipment at the inception of the lease was $100,000. Press has a 12% implicit rate on the lease. The following amortization table was prepared for the lease.

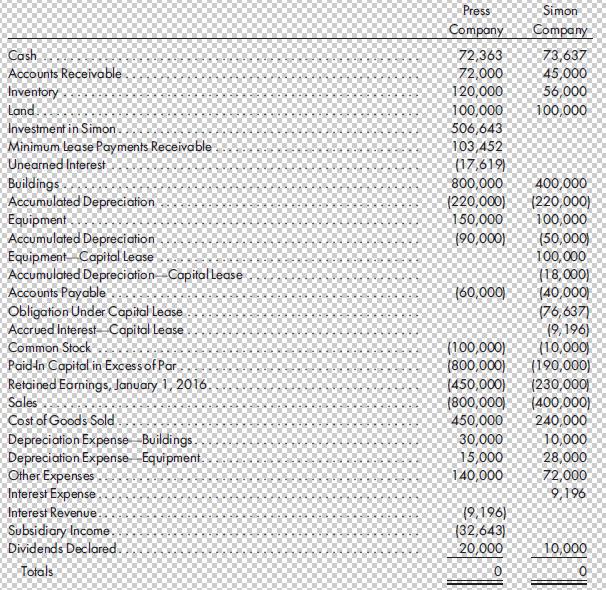

Press and Simon had the following trial balances on December 31, 2016:

Required

Prepare the worksheet necessary to produce the consolidated financial statements for Press Company and its subsidiary Simon Company for the year ended December 31, 2016. Include the determination and distribution of excess and income distribution schedules.

Preceding Facts for Press’s Acquisition:

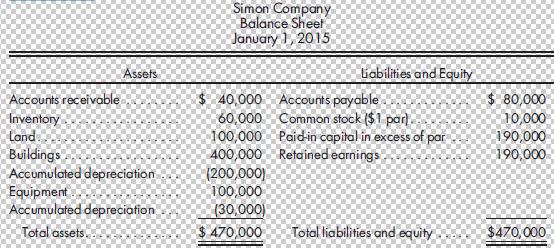

On January 1, 2015 Press Company acquired Simon Company. Press paid $450,000 for 80% of Simon’s common stock. On the date of acquisition, Simon had the following balance sheet:

Buildings, which have a 20-year life, are undervalued by $100,000. Any excess cost is considered to be goodwill.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng