Sabrina Ltd prepares financial statements at 31 December each year. On 1 January 2009, the company acquired

Question:

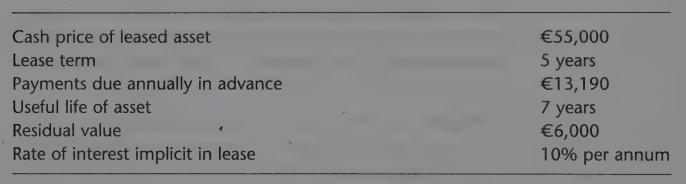

Sabrina Ltd prepares financial statements at 31 December each year. On 1 January 2009, the company acquired an asset by means of a finance lease. Details of the lease agreement are as follows:

Sabrina Ltd will obtain legal ownership of the asset at the end of the lease term. The company calculates depreciation on a straight-line basis.

(a) Determine the finance and depreciation charges which should be shown in the company’s income statements for each of the years to 31 December 2009, 2010, 2011, 2012 and 2013.

(b) Calculate the liability to the lessor at the end of each of these years and show how this liability should be split between current liabilities and noncurrent liabilities.

Step by Step Answer:

Advanced Financial Accounting An International Approach

ISBN: 9780273712749

1st Edition

Authors: Jagdish Kothari, Elisabetta Barone