Suppose you manage High Peaks Performance, Inc., a Vermont sporting goods store that lost money during the

Question:

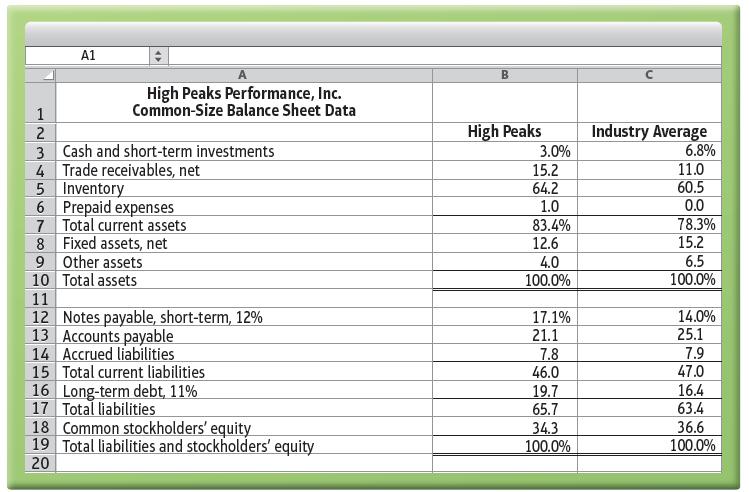

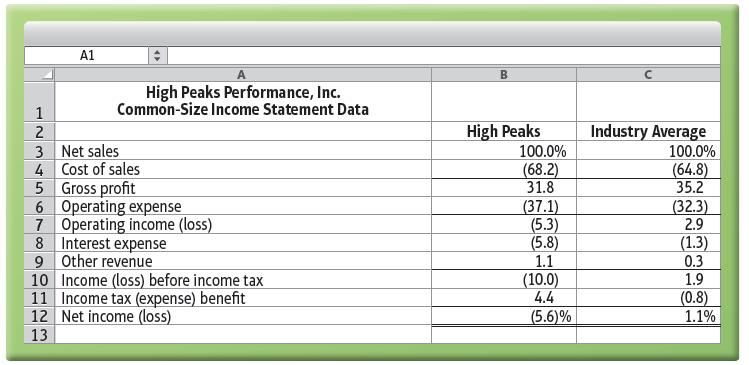

Suppose you manage High Peaks Performance, Inc., a Vermont sporting goods store that lost money during the past year. To turn the business around, you must analyze the company and industry data for the current year to learn what is wrong. The company’s data follow:

Requirement

Based on your analysis of these figures, suggest four courses of action High Peaks might take to reduce its losses and establish profitable operations. Give your reason for each suggestion.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted: