A company has granted (1,000,000) options to its employees. The stock price and strike price are both

Question:

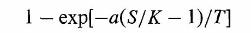

A company has granted \(1,000,000\) options to its employees. The stock price and strike price are both \(\$ 20\). The options last 10 years and vest after 3 years. The stock price volatility is \(30 \%\), the risk-free rate is \(5 \%\), and the company pays no dividends. Use a four-step tree to value the options. Assume that there is a probability of \(4 \%\) that an employee leaves the company at the end of each of the time steps on your tree. Assume also that the probability of voluntary early exercise at a node, conditional on no prior exercise, when

(a) the option has vested and

(b) the option is in the money, is

where \(S\) is the stock price, \(K\) is the strike price, \(T\) is the time to maturity, and \(a=2\).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: