Canterlot Chartered Accountants is a successful mid-tier accounting firm with a large range of clients across Australia.

Question:

Canterlot Chartered Accountants is a successful mid-tier accounting firm with a large range of clients across Australia. During the 2020 year, Canterlot gained a new client, Cloudsdale Medical Group (CMG), which owns 100 per cent of the following entities:

• Everfree Forest Hospital, a private hospital group

• Calendula Care, a private nursing home

• Tempo Cancer Treatment Limited (TCTL), a private oncology clinic that specialises in the treatment of cancer. Year-end for all CMG entities is 30 June.

During the 2020 financial year, Everfree Forest Hospital released its own range of medical supplies such as bandages and first aid kits, which are sold via direct marketing by a sales team employed by the hospital. The sales team are remunerated via a base salary and a bonus component which is based upon the dollar value of sales they generate. You recognise that their main motivation is to maximise their bonuses. You select a sample of payments received by the hospital post year-end and trace back to the general ledger and customer account balance.

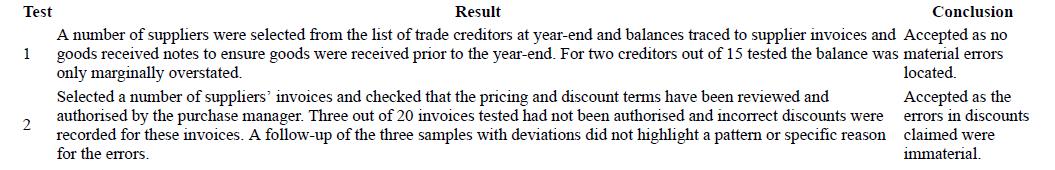

In addition, you are reviewing the results of a number of tests in relation to accounts payable at Calendula Care.

For each of the test results for Calendula Care:

(a) Identify whether this is a test of controls or a substantive test of detail.

(b) Determine the key assertion addressed by the test procedure.

(c) Explain why the conclusion reached is appropriate or inappropriate.

(d) Outline the key additional procedure that you believe needs to be performed.

Step by Step Answer:

Auditing A Practical Approach

ISBN: 9780730382645

4th Edition

Authors: Robyn Moroney, Fiona Campbell, Jane Hamilton