In your audit of the allowance for uncollectible accounts for Patrick Co., a wholesaler of hospital supplies,

Question:

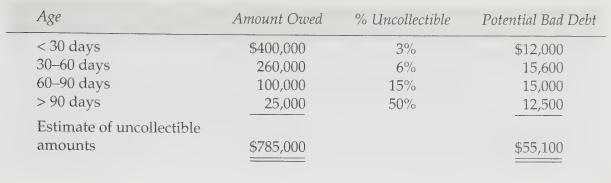

In your audit of the allowance for uncollectible accounts for Patrick Co., a wholesaler of hospital supplies, you prepare the following aging schedule:

a. What type of audit evidence is this schedule?

b. If the beginning balance in allowance for uncollectible accounts was \(\$ 51,000\), what amount would this schedule suggest should be the bad debt expense for the year?

c. Suppose the client declined to accrue any additional bad debt expense for the year (and you considered your answer in part \(\mathrm{b}\) to be a material amount). What reasonable arguments might the client advance to support his position?

d. What assumptions about the aging schedule are likely to have a large impact on the estimate?

e. What other evidence might the auditor gather to support his or her contention that additional bad debt expense should be accrued?

Step by Step Answer:

Auditing Assurance And Risk

ISBN: 9780324313185

3rd Edition

Authors: W. Robert Knechel, Steve Salterio, Brian Ballou