The information below relates to the audit of EyeMax Corporation, a client with a calendar year-end. EyeMax

Question:

The information below relates to the audit of EyeMax Corporation, a client with a calendar year-end. EyeMax has debt agreements associated with publicly traded bonds that require audited financial statements. The company is currently, and historically has been, in compliance with the covenants in the debt agreements. Further, management believes that having audited financial statements prepared in accordance with GAAP is important to shareholders and is “simply a good business practice.” Assume that audit fieldwork has been completed. At this point you are considering several items that have been posted to a “Summary of Unadjusted Misstatements.” The Summary of Unadjusted Misstatements is a listing auditors compile during an audit as they uncover potential or proposed corrections to the client’s financial statements. Additional detailed information about the items posted to the Summary of Unadjusted Misstatements is provided on the following pages. Based on the information provided, you will be asked to decide the minimum adjustment (if any) to the financial statements that would be necessary before issuing a “clean opinion.” Make sure you carefully consider materiality as you evaluate the misstatements because auditors do not require their clients to book immaterial adjustments. While it is considered best practice to correct errors discovered during the audit, there are situations where it is justifiable to make the corrections in the following period. Therefore, even if, for example, a client has followed a non-GAAP procedure, no adjustment would necessarily be required unless the impact is material (i.e., an individual adjustment(s) is greater than individual account tolerable misstatement or the aggregated sum of all misstatements is greater than overall materiality after considering relevant qualitative factors). At the end of this case you will also be asked several questions related to your decisions. Please carefully consider the following information before you answer the questions.

REQUIRED

Assume that you are the auditor responsible for the EyeMax audit. It is now March 30, and all planned fieldwork has been completed. Recall that total overall financial statement materiality has been set at $625,000 and tolerable misstatement is set equal to performance materiality, which is 75% of overall materiality. Taking into account the information provided, please answer the following question.

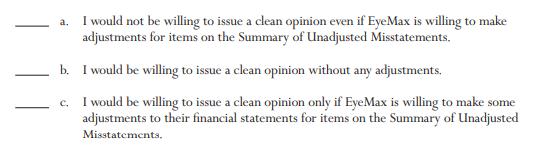

[1] Which of the following three alternatives best describes the conditions under which you would issue a clean opinion for EyeMax? (select one).

Briefly explain your choice:

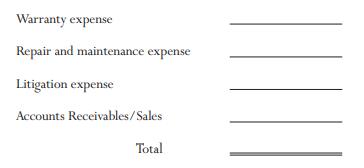

[2] If you selected options “a” or “b” in question 1, assume now that the client has decided that they will make an adjustment of up to $250,000 to their financial statements. Please decompose the total adjustment you would recommend into the individual account classifications included on the Summary of Unadjusted Misstatements in the space provided below (e.g., what adjustment would you require for warranty expense, repair and maintenance expense, etc? The dollar values of your individual account adjustments should sum to no more than $250,000).

If you selected item “c” in question 1, what is the minimum total adjustment that you would require before issuing a clean opinion? $ _______________. Please decompose this total adjustment into the individual account classifications included on the Summary of Unadjusted Misstatements in the space provided below (e.g., what adjustment, if any, would you require for warranty expense, repair and maintenance expense, etc? The dollar values of your individual account adjustments should sum to your required minimum adjustment).

Please briefly explain your decisions:

Step by Step Answer:

Auditing Cases An Interactive Learning Approach

ISBN: 9780134421827

7th Edition

Authors: Mark S Beasley, Frank A. Buckless, Steven M. Glover, Douglas F Prawitt